Date Filed:Chairman of the Board,

Chief Executive Officer and President

Amgen Inc.

One Amgen Center Drive

Thousand Oaks, CA 91320-1799

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

þ Filed by the registrant | ¨ |

| Check the appropriate box: | ||

| ¨ |

| |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) | |

| þ |

| |

| ¨ | ||

| ||

| ¨ | ||

| ||

Amgen Inc.AMGEN INC.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Payment of filing fee (check the appropriate box): | ||

| þ | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and |

(1) Title of each class of securities to which transaction applies: |

(2) Aggregate number of securities to which transaction applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction: |

(5) Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: |

(2) Form, Schedule or Registration Statement No.: |

(3) Filing Party: | ||

(4) Date Filed: |

Chief Executive Officer and President | ||

| ||

Amgen Inc. One Amgen Center Drive Thousand Oaks, CA 91320-1799 |

April 3, 2014

April 12, 2012

DEAR STOCKHOLDER:Dear Stockholder:

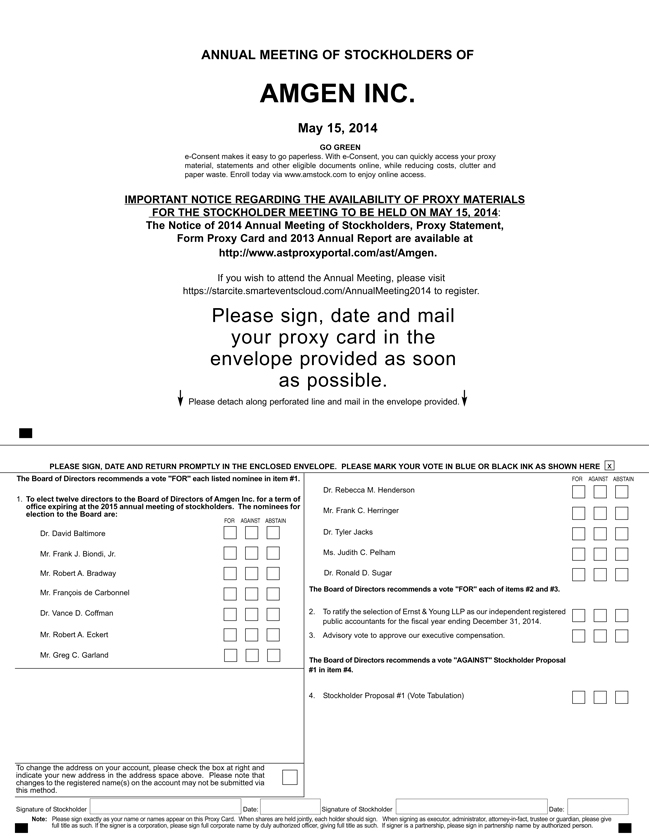

You are invited to attend the 20122014 Annual Meeting of Stockholders, or Annual Meeting, of Amgen Inc. to be held on Wednesday,Thursday, May 23, 2012,15, 2014, at 11:00 A.M., local time, at the Four Seasons Hotel Westlake Village, Two Dole Drive, Westlake Village, California 91362.

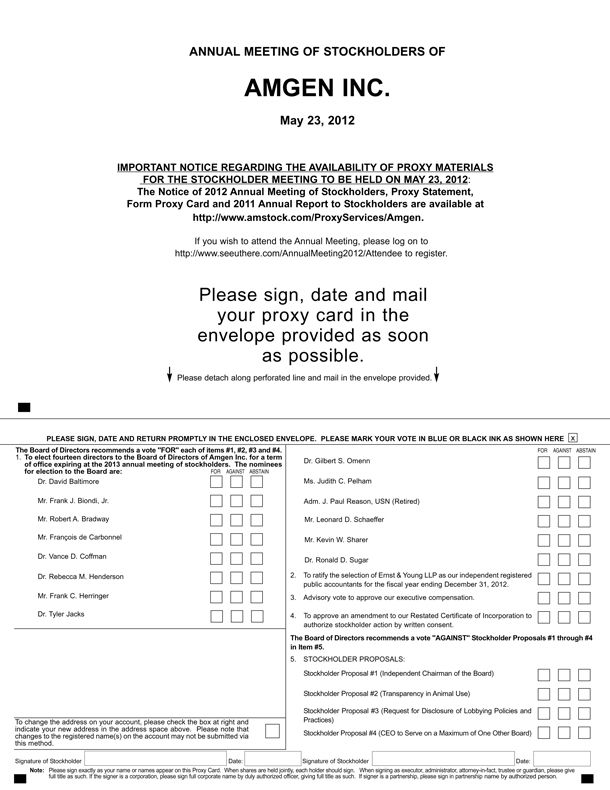

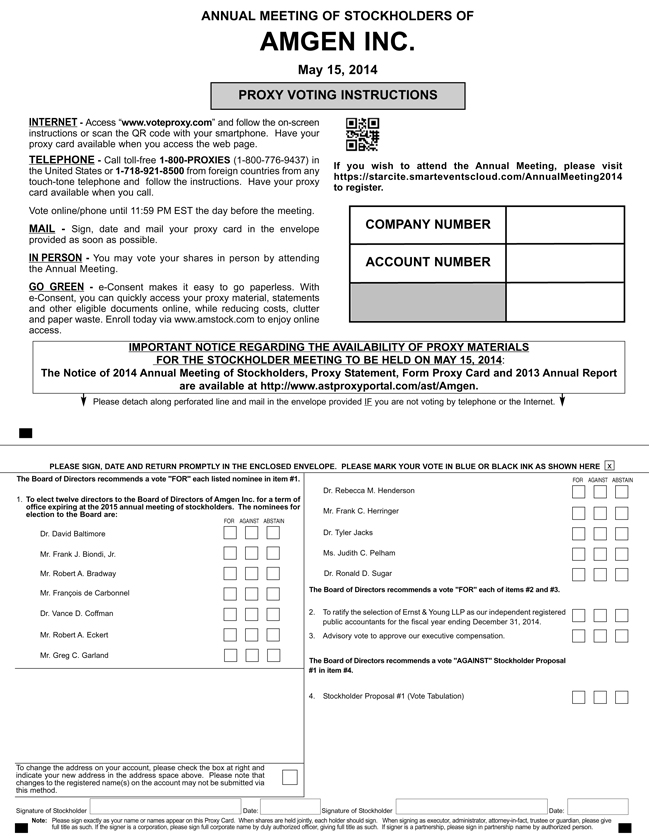

At this year’s Annual Meeting you will be asked to: (i) elect fourteen12 directors to serve for the ensuing year; (ii) ratify the selection of our independent registered public accountants; (iii) hold an advisory vote to approve our executive compensation; (iv) approve the proposed amendment to Amgen’s Restated Certificate of Incorporation, as amended, to authorizeconsider one stockholder action by written consent; (v) consider four stockholder proposals,proposal, if properly presented at the Annual Meeting and (vi)(v) transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. The accompanying Notice of Annual Meeting of Stockholders and proxy statement describe these matters. We urge you to read this information carefully.

The Board of Directors unanimously believes that the election of its nominees for directors, the ratification of its selection of independent registered public accountants and the advisory vote to approve our executive compensation and the amendment to Amgen’s Restated Certificate of Incorporation, as amended, are advisable and in Amgen’sthe best interests of Amgen and that of itsour stockholders. Accordingly, the Board of Directors recommends a vote FOR the election of the fourteen12 nominees for directors, FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accountants and FOR the advisory vote to approve our executive compensation and FOR the approval of the proposed amendment to Amgen’s Restated Certificate of Incorporation, as amended.compensation. The Board of Directors unanimously believes that the stockholder proposals areproposal is not in the best interests of Amgen and its stockholders, and, accordingly, recommends a vote AGAINST the stockholder proposals.proposal. In addition to the business to be transacted as described above, management will speak on our developments of the past year and respond to comments and questions of general interest to stockholders.

If you plan to attend the Annual Meeting, you will need an admittance ticket orand proof of ownership of our Common Stock as of the close of business on March 26, 2012.17, 2014. Please read “INFORMATION CONCERNING VOTING AND SOLICITATION—Attendance at the Annual Meeting” in the accompanying proxy statement.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. We are pleased to use the Securities and Exchange Commission rule that permits companies to furnish proxy materials to certain of our stockholders over the Internet. If you are viewing the proxy statement on the Internet, you may grantsubmit your proxy electronically via the Internet by following the instructions on the Notice Regarding the Availability of Proxy Materials previously mailed to you and the instructions listed on the Internet site. If you have received a paper copy of the proxy statement and proxy card, you may grant asubmit your proxy to vote your shares by completing and mailing the proxy card enclosed with the proxy statement, or you may grantsubmit your proxy electronically via the Internet or by telephone by following the instructions on the proxy card. If your shares are held in “street name,” which means shares held of record by a broker, bank, trust or other nominee, you should review the Notice Regarding the Availability of Proxy Materials or proxy statement and voting instruction form used by that firm to determine whether and how you will be able to submit your proxy by telephone or over the Internet. Submitting a proxy over the Internet, by telephone or by mailing a proxy card, will ensure your shares are represented at the Annual Meeting. Your vote is important, regardless of the number of shares that you own.

On behalf of the Board of Directors, I thank you for your participation. We look forward to seeing you on May 23.15.

Sincerely,

Kevin W. SharerRobert A. Bradway

Chairman of the Board, and

Chief Executive Officer and President

AMGEN INC.Amgen Inc.

One Amgen Center Drive

Thousand Oaks, California 91320-1799

Notice of Annual Meeting of Stockholders

To be Held on May 15, 2014

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2012

TO THE STOCKHOLDERS OF AMGEN INC.To the Stockholders of Amgen Inc.:

NOTICE IS HEREBY GIVEN that the 20122014 Annual Meeting of Stockholders, or Annual Meeting, of Amgen Inc., a Delaware corporation, will be held on Wednesday,Thursday, May 23, 2012,15, 2014, at 11:00 A.M., local time, at the Four Seasons Hotel Westlake Village, Two Dole Drive, Westlake Village, California 91362, for the following purposes:

| 1. | To elect |

| 2. | To ratify the selection of Ernst & Young LLP as our independent registered public accountants for the fiscal year ending December 31, |

| 3. | To hold an advisory vote to approve our executive compensation; |

| 4. |

|

To consider |

To transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders.

The Board of Directors has fixed the close of business on March 26, 201217, 2014 as the record date for the determination of stockholders entitled to notice of, and to vote at, this Annual Meeting and any continuation, postponement or adjournment thereof. Whether or not you plan on attending the Annual Meeting, we encourage you to submit your proxy as soon as possible using one of three convenient methods: (i) by accessing the Internet site described in these voting materials or voting instruction form provided to you; (ii) by calling the toll-free number in the voting instruction form provided to you or (iii) by signing, dating and returning any proxy card or instruction form provided to you. By submitting your proxy promptly, you will save the Company the expense of further proxy solicitation.

By Order of the Board of Directors

David J. Scott

Secretary

Thousand Oaks, California

April 12, 20123, 2014

| TABLE OF CONTENTS |

TABLE OF CONTENTSTable of Contents

ï 2014 Proxy Statement

ï 2014 Proxy Statement

| PROXY STATEMENT SUMMARY |

This summary contains highlights about our Company and the upcoming 2014 Annual Meeting of Stockholders. This summary does not contain all of the information that you should consider in advance of the meeting and we encourage you to read the entire proxy statement before voting.

2014 Annual Meeting of Stockholders

Date and Time: | Thursday, May 15, 2014 at 11:00 A.M., local time | |

Four Seasons Hotel Westlake Village, Two Dole Drive, Westlake Village, California 91362 | ||

Record Date: | March 17, 2014 | |

Mail Date: | We intend to mail the Notice Regarding the Availability of Proxy Materials, or the proxy statement and proxy card, as applicable, on or about April 3, 2014 to our stockholders. | |

Voting Matters and Board Recommendations

| Matter | Our | |

Election of | FOR each Director Nominee | |

Ratification of Selection of Independent Registered Public Accountants (page 17) | FOR | |

Advisory Vote to Approve Our Executive Compensation (page 18) | FOR | |

Stockholder Proposal (page 21) | AGAINST |

2013 Performance Highlights

Our stock price increased from $86.20 to $114.08 per share during 2013, with a one-year total shareholder return, or TSR, of 35%, including our dividends, and a three-year TSR of 114%.

We returned $1.4 billion of cash to our stockholders through dividends in 2013. Since the initiation of our first dividend in July 2011, we have raised the dividend three times over the previous quarterly amount by an average of 30% and returned a total of $3 billion of cash to our stockholders through dividends. In addition, we repurchased $0.8 billion of our stock in 2013 for a total return of capital of $2.2 billion to our stockholders.

We grew revenues by 8% over 2012 to $18.7 billion in 2013.

| • | We grew adjusted net income by 14% to $5.8 billion(1) in 2013. |

| • | Our year-over-year adjusted earnings per share growth is 17%.(1) |

We effectively advanced the pipeline and successfully acquired Onyx Pharmaceuticals, Inc.

| (1) | Adjusted net income and adjusted earnings per share are reported and reconciled in our Form 8-K dated as of January 28, 2014. |

ï 2014 Proxy Statement1

ï 2014 Proxy Statement1

| PROXY STATEMENT SUMMARY |

Executive Compensation Highlights

Each element of direct compensation for our executive officers in 2013 was targeted at the market median of our peer group.

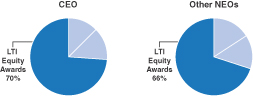

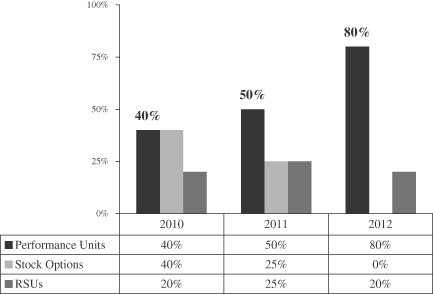

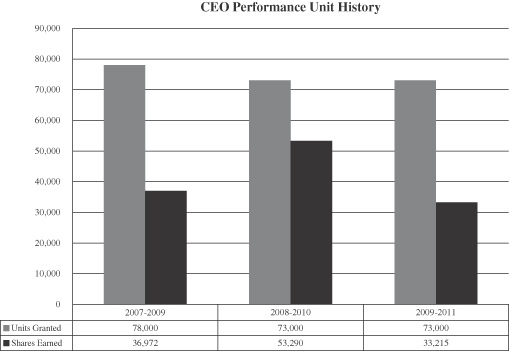

Our equity award pay mix is 80% performance units and 20% time-vested restricted stock units.

Performance units under our long-term incentive performance award program are earned and paid in shares based strictly on our TSR performance as compared to our comparator group (for awards granted in

2013 and 2014, the Standard & Poor’s 500) over a three-year performance period. |

AMGEN INC.

One Amgen Center Drive

Thousand Oaks, California 91320-1799Corporate Governance Highlights

The independent members of our Board of Directors, or Board, elected Vance D. Coffman as our lead independent director with specific and significant duties. We have active participation by all directors, including the 11 independent director nominees. We believe that the current structure of our Board best positions us to benefit from the respective strengths of our Chief Executive Officer, or CEO, and lead independent director. (page 28)

11 of our 12 director nominees (all directors except our CEO) meet the criteria for independence under The NASDAQ Stock Market listing standards and the requirements of the Securities and Exchange Commission. Additionally, all members of the Audit, Compensation and

Management Development, Corporate Responsibility and Compliance and Governance and Nominating Committees are independent. (page 32) |

Our independent directors meet privately on a regular basis.

The Amended and Restated Bylaws of Amgen Inc. provide for a majority voting standard for uncontested director elections.

We hold an annual advisory vote to approve our executive compensation. (page 18)

We have significant stock ownership requirements. (page 58)

PROXY STATEMENT2  ï 2014 Proxy Statement

ï 2014 Proxy Statement

Amgen Inc.

One Amgen Center Drive

Thousand Oaks, California 91320-1799

Proxy Statement

Information Concerning Voting and Solicitation

General

The enclosed proxy is solicited on behalf of the Board of Directors, or Board, of Amgen Inc., a Delaware corporation, for use at our 20122014 Annual Meeting of Stockholders, or Annual Meeting, to be held on Wednesday,Thursday, May 23, 2012,15, 2014, at 11:00 A.M., local time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting of Stockholders and any business properly brought before the Annual Meeting. Amgen may also be referred to as the Company, we, us or our in this proxy statement. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting. The Annual Meeting will be held at the Four Seasons Hotel Westlake Village, Two Dole Drive, Westlake Village, California 91362.

Pursuant to the rules adopted by the Securities and Exchange Commission, or SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials, or Notice, to certain of our stockholders of record, and we are sending a paper copy of the proxy materials and proxy card to other stockholders of record who we believe would prefer receiving such materials in paper form. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice. Stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this proxy statement available on the Internet and to mail the Notice, or to mail the proxy statement and proxy card, as applicable, on or about April 12, 20123, 2014 to all stockholders entitled to notice of and to vote at the Annual Meeting.

In this proxy statement when we refer to our fiscal year, we mean the twelve-month period ending December 31 of the stated year (for example, fiscal 2011 is January 1, 2011 through December 31, 2011), unless specifically stated otherwise.

Important Notice Regarding the Availability of Proxy Materials for the 20122014 Stockholder Meeting to Be Held on May 23, 2012.15, 2014.

This proxy statement, our 20112013 annual report and our other proxy materials are available at:www.amstock.com/ProxyServices/www.astproxyportal.com/ast/Amgen. At this website, you will find a complete set of the following proxy materials: notice of 20122014 annual meeting of stockholders; proxy statement; 20112013 annual report to stockholders and form proxy card. You are encouraged to access and review all of the important information contained in the proxy materials before submitting a proxy or voting at the meeting.

What Are You Voting On?

You will be entitled to vote on the following proposals at the Annual Meeting:

The election of fourteen12 directors to serve on our Board for a term of office expiring at the 20132015 annual meeting of stockholders;

The ratification of the selection of Ernst & Young LLP as our independent registered public accountants for the fiscal year ending December 31, 2012;2014;

The advisory vote to approve our executive compensation;

The proposed amendment to our Restated Certificate of Incorporation, as amended, to authorizeOne stockholder action by written consent;proposal, if properly presented; and

Four stockholder proposals, ifAny other business as may properly presented.come before the Annual Meeting.

Who Can Vote

The Board has set March 26, 201217, 2014 as the record date for the Annual Meeting. You are entitled to notice and to vote if you were a stockholder of record of our common stock, $.0001

ï 2014 Proxy Statement3

ï 2014 Proxy Statement3

| INFORMATION CONCERNING VOTING AND SOLICITATION |

par value per share, or Common Stock, as of the close of business on March 26, 2012.17, 2014. You are entitled to one vote on each proposal for each share of Common Stock you held on the record date. Your shares may be voted at the Annual Meeting only if you are present in person or your shares are represented by a valid proxy.

Difference Between a Stockholder of Record and a “Street Name” Holder

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares. However, you are still considered to be the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot submit a proxy or vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the methods described below.

Shares Outstanding and Quorum

At the close of business on March 26, 2012,17, 2014, there were 782,409,949756,487,286 shares of our Common Stock outstanding and entitled to vote at the Annual Meeting. The presence of a majority of the outstanding shares of our Common Stock entitled to vote constitutes a quorum, which is required to hold and conduct business at the Annual Meeting. Shares are counted as present at the Annual Meeting if:

you are present in person at the Annual Meeting; or

your shares are represented by a properly authorized and submitted proxy (submitted by mail, by telephone or over the Internet).

If you are a record holder and you submit your proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of determining a quorum. If your shares are held in “street name,” your shares are counted as present for purposes of determining a quorum if your broker, bank, trust or other nominee submits a proxy covering your shares. Your broker, bank, trust or other nominee is entitled to submit a proxy covering your shares as

to certain “routine” matters, even if you have not instructed your broker, bank, trust or other nominee on how to vote on those matters. Please see the subsection “If You Do Not Specify How You Want Your Shares Voted” below. In the absence of a quorum, the Annual Meeting may be adjourned, from time to time, by vote of the holders of a majority of the shares represented thereat, but no other business shall be transacted at such meeting.

Voting Your Shares

You may vote by attending the Annual Meeting and voting in person or you may vote by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the Internet or receiving a paper copy and (2) for shares held as a record holder and shares held in “street name.”

Shares Held as a Record Holder.If you hold your shares of Common Stock as a record holder and you are viewing this proxy statement on the Internet, you may vote by submittingsubmit a proxy over the Internet by following the instructions on the website referred to in the Notice previously mailed to you. You may request paper copies of the proxy statement and proxy card by following the instructions on the Notice. If you hold your shares of

Common Stock as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by submittingsubmit a proxy over the Internet or by telephone by following the instructions on the proxy card, or by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the pre-addressed, postage-paid envelope provided to you.

Shares Held in Street Name.If you hold your shares of Common Stock in street name, you will receive a Notice from your broker, bank, trust or other nominee that includes instructions on how to vote your shares. Your broker, bank, trust or other nominee may allow you to deliver your voting instructions over the Internet and may also permit you to submit your voting instructions by telephone. In addition, you may request paper copies of the proxy statement and proxy card from your broker by following the instructions on the Notice provided by your broker, bank, trust or other nominee.

The Internet and telephone voting facilities will close at 11:59 P.M., Eastern Time, on May 22, 2012.14, 2014. Stockholders who submit a proxy through the Internet or telephone should be aware that they may incur costs to access the Internet or telephone, such as usage charges from telephone companies or Internet service

4  ï 2014 Proxy Statement

ï 2014 Proxy Statement

| INFORMATION CONCERNING VOTING AND SOLICITATION |

providers and that these costs must be borne by the stockholder. Stockholders who submit a proxy by Internet or telephone need not return a proxy card or the form forwarded by your broker, bank, trust or other holder of record by mail.

YOUR VOTE IS VERY IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting.

Voting in Person

If you plan to attend the Annual Meeting and wish to vote in person, you may request a ballot at the Annual Meeting. Please note that if your shares are held of record by a broker, bank, trust or other nominee, and you decide to attend and vote at the Annual Meeting, your vote in person at the Annual Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your broker, bank, trust or other nominee). Even if you intend to attend the Annual Meeting, we encourage you to submit your proxy to vote your shares in advance of the Annual Meeting. Please see the important instructions and requirements below regarding “Attendance at the Annual Meeting.”

Changing Your Vote

As a stockholder of record, if you vote bysubmit a proxy, you may revoke that proxy or change your vote at any time before it is voted at the Annual Meeting. Stockholders of record may revoke a proxy or change his or her vote prior to the Annual Meeting by (i) delivering a written notice of revocation to the attention of the Secretary of the Company at our principal executive offices at One Amgen Center Drive, Thousand Oaks, California 91320-1799, Mail Stop 38-5-A, (ii) duly submitting a later-dated proxy over the Internet, by mail or by telephone or (iii) attending the Annual Meeting in person and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

If your shares are held in the name of a broker, bank, trust or other nominee, you may change your voting instructions by following the instructions of your broker, bank, trust or other nominee.

If You Receive More Than One Proxy Card or Notice

If you receive more than one proxy card or Notice, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit a proxy by telephone or the Internet, submit one proxy for each proxy card or Notice you receive.

How Will Your Shares Be Voted

Stockholders of record as of the close of business on March 26, 201217, 2014 are entitled to one vote for each share of our Common Stock held on all matters to be voted upon at the Annual Meeting. All shares entitled to vote and represented by properly submitted proxies received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies.YOUR VOTE IS VERY IMPORTANT.

If You Do Not Specify How You Want Your Shares Voted

As a stockholder of record, if you submit a signed proxy card or submit your proxy by telephone or Internet and do not specify how you want your shares voted, the proxy holder will vote your shares:

FOR the election of the fourteen12 nominees listed in this proxy statement to serve on our Board for a term of office expiring at the 20132015 annual meeting of stockholders;

FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accountants for the fiscal year ending December 31, 2012;2014;

FOR the advisory vote to approve our executive compensation;

FOR the amendment to our Restated Certificate of Incorporation, as amended, to authorize stockholder action by written consent; and

AGAINST the fourone stockholder proposals,proposal, if properly presented.

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner has not received voting instructions from the beneficial owner and the nominee does not have discretionary authority to vote the shares. If you hold your shares in street name and do not provide voting instructions to your broker or other nominee, your shares will be considered to be broker non-votes and will not be voted on any proposal on which your broker or other nominee does not have discretionary authority to vote. Shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum, but will not be considered entitled to vote on the proposal in question. Brokers generally have discretionary authority to vote on the ratification of the selection of Ernst & Young LLP as our independent registered public accountants. Brokers, however, do not have discretionary authority to vote on the election of directors to serve on our Board, the advisory vote to approve our executive compensation the amendment to our Restated Certificate of Incorporation or on any stockholder proposal.proposals.

ï 2014 Proxy Statement5

ï 2014 Proxy Statement5

| INFORMATION CONCERNING VOTING AND SOLICITATION |

In their discretion, the proxy holders named in the proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The Board knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this proxy statement. In addition, other than the stockholder proposalsproposal described in this proxy statement, no other stockholder proposal or nomination was received on a timely basis, so no such matters may be brought to a vote at the Annual Meeting.

Counting of Votes

All votes will be tabulated as required by Delaware law, the state of our incorporation, by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Shares held by persons attending the Annual Meeting but not voting, shares represented by proxies that reflect abstentions as to one or more proposals and broker non-votes will be counted as present for purposes of determining a quorum.

Election of Directors.We have a majority voting standard for the election of directors in an uncontested elections,election, which is generally defined as an election in which the number of nominees does not exceed the number of directors to be elected at the meeting. In the election of directors, you may either vote “for,” “against” or “abstain.”“abstain” for each nominee. Cumulative voting is not permitted. Under our majority voting standard, in uncontested elections of directors, such as this election, each director must be elected by the affirmative vote of a majority of the votes cast by the shares present in person or represented by proxy and entitled to vote. A “majority of the votes cast” means that the number of votes cast “for” a director nominee exceeds the number of votes cast “against” the nominee. For these purposes, abstentions will not count as a vote “for” or “against” a nominee’s election and thus will have no effect in determining whether a director nominee has received a majority of the votes cast. Brokers do not have discretionary authority to vote on this proposal. Broker non-votes will have no effect on the election of directors as brokers are not entitled to vote on this proposal.for or against a nominee without instruction from the beneficial owner. If a director nominee is an incumbent director and does not receive a majority of the votes cast in an uncontested election, that director will continue to serve on the Board as a “holdover” director, but must tender his or her resignation to the Board promptly after certification of the election results

of the stockholder vote. The Governance and Nominating Committee of the Board will then

recommend to the Board whether to accept the resignation or whether other action should be taken. The Board will act on the tendered resignation, taking into account the recommendation of the Governance and Nominating Committee, and the Board’s decision will be publicly disclosed within 90 days after certification of the election results of the stockholder vote. A director who tenders his or her resignation after failing to receive a majority of the votes cast will not participate in the recommendation of the Governance and Nominating Committee or the decision of the Board with respect to his or her resignation.

Ratification of Auditors.The ratification of the selection of Ernst & Young LLP requires the affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. Abstentions will have the same effect as votes “against” the ratification. Because brokers have discretionary authority to vote on the ratification, we do not expect any broker non-votes in connection with the ratification.

Advisory Vote on Executive Compensation.The approval of the advisory vote on our executive compensation requires the affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. Abstentions will have the same effect as votes “against” the proposal. Brokers do not have discretionary authority to vote on this proposal. Brokernon-votes, however, will have no effect on the proposal as brokers are not entitled to vote on such proposal in the absence of voting instructions from the beneficial owner.

Amendment to Our Restated Certificate of Incorporation.Stockholder Proposal. The approval of the proposed amendment to our Restated Certificate of Incorporation, as amended, to authorize stockholder action by written consent requires the affirmative vote of the holders of not less than a majority of the outstanding shares of our Common Stock entitled to vote on the matter. In addition, the proposed amendment will be effective only if a Certificate of Amendment to the Restated Certificate of Incorporation, which includes the amendment to the Restated Certificate of Incorporation, as amended, approved by stockholders, is filed with the Secretary of State of the State of Delaware. Abstentions will have the same effect as votes against the proposed amendment to the Restated Certificate of Incorporation. Brokers do not have discretionary authority to vote on this proposal, and broker non-votes will have the same effect as votes against the proposal.

Stockholder Proposals.The approval of each of the stockholder proposals, if properly presented at the Annual Meeting, requires the affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. Abstentions will have the same effect as votes “against” such proposal. Brokers do not have discretionary authority to vote on these proposals.the proposal. Broker non-votes, therefore, will have no effect on the four stockholder proposalsproposal as brokers are not entitled to vote on such proposalsproposal in the absence of voting instructions from the beneficial owner.

Inspector of Election

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

6 �� ï 2014 Proxy Statement

ï 2014 Proxy Statement

| INFORMATION CONCERNING VOTING AND SOLICITATION |

Solicitation of Proxies

We will bear the entire cost of solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy, the Notice and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of our Common Stock in their names that are beneficially owned by others to forward to those beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to the beneficial owners. Original solicitation of proxies may be supplemented by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or staff members. No additional compensation will be paid to our directors, officers or staff members for such services. In addition, we have retained Georgeson Inc.AST Phoenix Advisors to assist in the solicitation of proxies for a fee of approximately $200,000$150,000 plus distribution costs and other costs and expenses. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting during ordinary business hours at our principal

executive offices at One Amgen Center Drive, Thousand Oaks, California, 91320-1799 for the ten days prior to the Annual Meeting and also at the Annual Meeting.

Attendance at the Annual Meeting

To attend the Annual Meeting, you will need an admittance ticket and proof of ownership of our Common Stock as of the close of business on March 26, 2012.17, 2014. If you have received a paper copy of the proxy statement, to receive an admittance ticket you will need to complete and return the postage-paid reply card attached to this proxy statement. If you received electronic delivery of this proxy statement, you will receive an e-mail with instructions for obtaining an admittance ticket. If you are viewing the proxy statement over the Internet, please follow the instructions indicated on the website referred to in the Notice. Each stockholder is entitled to one admittance ticket. Directions to attend the Annual Meeting will be sent with your admittance ticket and are available at the website referred to in the Notice andwww.amstock.com/ProxyServices/Amgen.www.astproxyportal.com/ast/Amgen.

You must bring certain documents with you to be admitted to the Annual Meeting. The purpose of this requirement is to help us verify that you are actually a stockholder of the

Company. Please read the following rules carefully, because they specify the documents that you must bring with you to the Annual Meeting to be admitted. The items that you must bring with you differ depending upon whether or not you were a record holder of the Company’s Common Stock as of the close of business on March 26, 2012.17, 2014. A “record holder” of stock is someone whose shares of stock are registered in his or her name in the records of the Company’s transfer agent. Many stockholders are not record holders because their shares of stock are registered in the name of their broker, bank, trust or other nominee, and the broker, bank, trust or other nominee is the record holder instead.All persons must bring a valid personal photo identification (such as a driver’s license or passport). If you are a record holder, at the Annual Meeting, we will check your name for verification purposes against our list of record holders as of the close of business on March 26, 2012.17, 2014.

If a broker, bank, trust or other nominee was the record holder of your shares of Common Stock as of the close of business on March 26, 2012,17, 2014, then you must also bring to the Annual Meeting:

Proof that you owned shares of our Common Stock as of the close of business on March 26, 2012.17, 2014.

If you intend to vote at the Annual Meeting, the executed proxy naming you as the proxy holder, signed by the broker, bank, trust or other nominee who was the record holder of your shares of Common Stock as of the close of business on March 17, 2014.

Examples of proof of ownership include the following: (1) an original or a copy of the voting information form from your bank or broker with your name on it; (2) a letter from your bank or broker stating that you owned shares of our Common Stock as of the close of business on March 26, 201217, 2014 or (3) a brokerage account statement indicating that you owned shares of our Common Stock as of the close of business on March 26, 2012.17, 2014.

If you are a proxy holder for a stockholder of the Company who owned shares of our Common Stock as of the close of business on March 26, 2012,17, 2014, then you must also bring to the Annual Meeting:

The executed proxy naming you as the proxy holder, signed by a stockholder of the Company who owned shares of our Common Stock as of the close of business on March 26, 2012.17, 2014.

ï 2014 Proxy Statement7

ï 2014 Proxy Statement7

| ITEM 1 — ELECTION OF DIRECTORS |

ELECTION OF DIRECTORSElection of Directors

Under ourthe Amgen Inc. Restated Certificate of Incorporation as amended, or Certificate of Incorporation, and ourthe Amended and Restated Bylaws of Amgen Inc., the Board of Directors, or Board, has the power to set the number of directors from time to time by resolution. TheOn July 8, 2013, Leonard D. Schaeffer resigned from our Board, has currently fixedand on October 16, 2013, Greg C. Garland was appointed to serve on our Board. Gilbert S. Omenn will not be standing for re-election to the Board at the 2014 Annual Meeting of Stockholders, or Annual Meeting. Effective as of the Annual Meeting, the Board will fix the authorized number of directors at thirteen and increased it to fourteen contingent upon all12. Effective January 1, 2014, the independent members of the nominees for director set forth below beingour Board elected including Dr. Tyler Jacks, a new nominee for director. In October 2011, Robert A. Bradway was appointedVance D. Coffman to serve for another

term as aour lead independent director with specific and significant duties as a result, we currently have thirteen directors in office.discussed under “Corporate Governance.” Based upon the recommendation of our Governance and Nominating Committee, the Board has nominated each of the current directors set forth below to stand for re-election, eachor in the case of whom is currently a director, and Dr. JacksMr. Garland to stand for initial election by our stockholders, in each case for a one-year term expiring at our 20132015 annual meeting of stockholders and until his or her successor is elected and qualified, or until his or her earlier retirement, resignation, disqualification, removal or death.

Nominee | Age | Director Since | Audit | Governance and Nominating | Executive | Compensation and Management Development | Equity Award | Corporate Responsibility and Compliance | ||||||||||||

Dr. David Baltimore | 74 | 1999 | X | X | ||||||||||||||||

Mr. Frank J. Biondi, Jr. | 67 | 2002 | C | X | ||||||||||||||||

Mr. Robert A. Bradway | 49 | 2011 | ||||||||||||||||||

Mr. François de Carbonnel | 65 | 2008 | X | X | ||||||||||||||||

Dr. Vance D. Coffman | 68 | 2007 | C | X | X | X | ||||||||||||||

Dr. Rebecca M. Henderson | 51 | 2009 | X | X | ||||||||||||||||

Mr. Frank C. Herringer | 69 | 2004 | X | X | C | C | ||||||||||||||

Dr. Tyler Jacks | 51 | n/a | ||||||||||||||||||

Dr. Gilbert S. Omenn | 70 | 1987 | X | X | ||||||||||||||||

Ms. Judith C. Pelham | 66 | 1995 | X | X | ||||||||||||||||

Admiral J. Paul Reason, USN (Retired) | 71 | 2001 | X | X | ||||||||||||||||

Mr. Leonard D. Schaeffer | 66 | 2004 | X | X | C | |||||||||||||||

Mr. Kevin W. Sharer | 64 | 1992 | C | X | ||||||||||||||||

Dr. Ronald D. Sugar | 63 | 2010 | X | X | ||||||||||||||||

| Nominee | Age | Director Since | Audit | Governance and Nominating | Executive | Compensation and Management Development | Equity Award | Corporate Responsibility and Compliance | ||||||||||||||||||||||||

David Baltimore | 76 | 1999 | X | X | ||||||||||||||||||||||||||||

Frank J. Biondi, Jr. | 69 | 2002 | C | X | X | |||||||||||||||||||||||||||

Robert A. Bradway | 51 | 2011 | C | X | ||||||||||||||||||||||||||||

François de Carbonnel | 67 | 2008 | X | X | ||||||||||||||||||||||||||||

Vance D. Coffman | 70 | 2007 | C | X | X | X | ||||||||||||||||||||||||||

Robert A. Eckert | 59 | 2012 | X | X | ||||||||||||||||||||||||||||

Greg C. Garland | 56 | 2013 | X | X | ||||||||||||||||||||||||||||

Rebecca M. Henderson | 53 | 2009 | X | X | ||||||||||||||||||||||||||||

Frank C. Herringer | 71 | 2004 | X | X | C | C | ||||||||||||||||||||||||||

Tyler Jacks | 53 | 2012 | X | X | ||||||||||||||||||||||||||||

Judith C. Pelham | 68 | 1995 | X | X | ||||||||||||||||||||||||||||

Ronald D. Sugar | 65 | 2010 | X | X | C | |||||||||||||||||||||||||||

| “C” |

|

Vacancies on the Board (including any vacancy created by an increase in the size of the Board) may be filled only by a majority of the directors remaining in office, even though less than a quorum.quorum of the Board. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the size of the Board) will serve until the next annual meeting of stockholders and until such director’s successor is elected and qualified, or until such director’s earlier retirement, resignation, disqualification, removal or death.

If any nominee should become unavailable for election prior to the 2012 Annual Meeting of Stockholders, or Annual Meeting, an event that currently is not anticipated by the Board, the proxies will be voted in favor of the election of a substitute nominee or nominees proposed by the Board or the number of directors may be reduced accordingly. Each nominee has agreed to serve if elected and the Board has no reason to believe that any nominee will be unable to serve.

8  ï 2014 Proxy Statement

ï 2014 Proxy Statement

| ITEM 1 — ELECTION OF DIRECTORS |

THE BOARD RECOMMENDS THAT THE STOCKHOLDERSA VOTE “FOR” EACH OF THE NOMINEES NAMED BELOW. PROXIES WILL BE VOTED “FOR” THE ELECTION OF THE NOMINEES UNLESS OTHERWISE SPECIFIED.

Set forth below is biographical information for each nominee and a summary of the specific qualifications, attributes, skills and experiences which led our Board to conclude that each nominee should serve on the Board at this time. All of our directors meet the qualifications and skills of our Amgen Inc. Board of Directors Guidelines for Director Qualifications and Evaluations inAppendix A. There are no family relationships among any of our directors or among any of our directors and our executive officers.

DAVID BALTIMOREDavid Baltimore

Dr.

David Baltimore is President Emeritus and Robert Andrews Millikan Professor of Biology at the California Institute of Technology, or Caltech. He received the Nobel Prize in Medicine as a co-recipient in 1975. Dr. Baltimore has been a director of Regulus Therapeutics Inc., a biopharmaceutical company, since 2008, serving on its Compensation Committee and chairing its Nominating and Governance Committee. Dr. Baltimore was a director of BB Biotech, AG, a Swiss investment company, from 20041994 to March 2011 and served as a director of MedImmune, Inc., a privately-held antibody formulation company, from 2003 to 2007. He has also been a directormember of Regulus Therapeutics Inc., a privately-held biopharmaceutical company, since 2008, andthe board of directors of Immune Design Corp. (formerly Vaccsys), a privately-held vaccine company of which he is a founder, since 2008. Also in 2008, he became a founder of Calimmune, Inc., a privately-held company developing a stem-cell HIV/AIDS therapy, and serves as Chairman of the board of directors.

Dr. Baltimore was President of Caltech from 1997 to 2006. Prior to this, he was a professor at the Massachusetts Institute of Technology, or MIT, and at The Rockefeller University where he also served as the President. During this time he was also the Chairman of the National Institutes of

Health AIDS Vaccine Research Committee, a director and member of the Whitehead Institute for Biomedical Research, and a professor of microbiology and research professor of the American Cancer Society. He was a postdoctoral fellow at MIT and Albert Einstein College of Medicine and on the staff of The Salk Institute for Biological Studies. Dr. Baltimore has been awarded honorary degrees from numerous institutions, including Harvard, Yale and Columbia.

Dr. Baltimore holds leadership roles in a number of scientific and philanthropic non-profit organizations, currently serving as a director and member of the Board of Scientific Counselors of the Broad Institute of MIT and Harvard, a director of the Foundation for Biomedical Research, and a member of the Human Genome Organisation.Organisation and a member of the scientific advisory board of Immune Design Corp.

The Board concluded that Dr. Baltimore should serve on the Board because Dr. Baltimore has spent his career in scientific academia at a number of well-known and highly regarded institutions. This experience provides Dr. Baltimore with extensive scientific knowledge and a deep understanding of our industry and of the research and development activities and operations of our Company.

ROBERT A. BRADWAYï 2014 Proxy Statement9

Mr. Robert A. Bradway has served as a director of the Company since October 2011. Mr. Bradway has been the Company’s President and Chief Operating Officer since May 2010 and will succeed to the role of Chief Executive Officer in May 2012. Mr. Bradway joined the Company in 2006 as Vice President, Operations Strategy and served as Executive Vice President and Chief Financial Officer from April 2007 to May 2010. Prior to joining the Company, he was a Managing Director and Head of International Banking at Morgan Stanley in London since 2001 where he had responsibility for the firm’s banking department and corporate finance activities in Europe and focused on healthcare.

| ITEM 1 — ELECTION OF DIRECTORS |

Mr. Bradway has been a director of Norfolk Southern Corporation, a transportation company, since July 2011, serving on its Audit and Finance Committees.

The Board concluded that Mr. Bradway should serve on the Board due to Mr. Bradway’s knowledge of all aspects of our business, combined with his leadership and management skills having served as our President and Chief Operating Officer and formerly our Chief Financial Officer. During this time, Mr. Bradway provided strong leadership through a variety of challenges and this positions him well to serve as a director and provides the Board with a knowledgeable perspective with regard to the Company’s products and operations.

FRANKFrank J. BIONDIBiondi

Mr.

Frank J. Biondi, Jr. has served as Senior Managing Director of WaterView Advisors LLC, an investment advisor organization, since 1999. Prior to WaterView Advisors, Mr. Biondi was the Chairman and Chief Executive Officer of Universal Studios, Inc. from 1996 to 1998, the President and Chief Executive Officer of Viacom, Inc. from 1987 to 1996, Executive Vice President of Entertainment Business Sector of The Coca-Cola Company and Chairman and Chief Executive Officer of Coca-Cola Television from 1985 to 1987, Chairman and Chief Executive Officer of Time Inc.’s subsidiary Home Box Office, Inc. from 1982 to 1984, Vice President of Time Inc. from 1978 to 1984 and Chairman and Chief Executive Officer of its subsidiary Home Box Office, Inc. in 1984 and Assistant Treasurer of the Children’s Television Workshop from 1974 to 1978.

Mr. Biondi has been a director of Cablevision Systems Corp., a telecommunications, media and entertainment company, since 2005,2005; Hasbro, Inc., a toy and games company, since 1999,2002, serving on its Compensation and Nominating, Governance and Social Responsibility Committees; Seagate Technology, a manufacturer of hard disk drives, since 2005, serving on its Compensation Committee and chairing its Finance Committee; and RealD Inc., a global licensor of three-dimensional technologies, since July 2010. He2010, serving on

its Audit Committee and chairing its Compensation Committee. Mr. Biondi serves onas the Compensation and Nominating and Governance Committees of Hasbro, on the Audit, Compensation and Finance and Strategic and Financial Transactions Committees of Seagate Technology and on the Compensation and Audit Committeeslead director of RealD. From 2008 until May 2010, Mr. Biondi was a director of Yahoo! Inc., a provider of Internet services, serving on its Compensation Committee. From 2002 to 2008, he was a director of Harrahs Entertainment, Inc., a gaming corporation, serving on its Compensation and Governance Committees, and from 1995 to 2008 he was a director of The Bank of New York Mellon Corporation, an asset management and securities services company, serving on its Compensation and Risk Committees. He has also been a director of Vail Resorts, Inc., a mountain resort operator, and The Seagram Company, a liquor and spirits company.

The Board concluded that Mr. Biondi should serve on the Board due to Mr. Biondi’s experience as chief executive officer of many large, public companies and his current role with WaterView Advisors which provide valuable management and leadership skills, as well as an understanding of the operations and financial results and prospects of our Company. Given his financial and leadership experience, Mr. Biondi has been determined to be an Audit Committee financial expert by our Board.

VANCE D. COFFMANRobert A. Bradway

Dr. Vance D. Coffman

Robert A. Bradway has served as our director since October 2011 and Chairman of the Board since January 1, 2013. Mr. Bradway has been our President since May 2010 and Chief Executive Officer since May 2012. From May 2010 to May 2012, Mr. Bradway served as our Chief Operating Officer. Mr. Bradway joined Amgen in 2006 as Vice President, Operations Strategy and served as Executive Vice President and Chief Financial Officer from April 2007 to May 2010. Prior to joining Amgen, he was a Managing Director at Morgan Stanley in London where he had responsibility for the firm’s banking department and corporate finance activities in Europe and focused on healthcare.

Mr. Bradway has been a director of 3M Company,Norfolk Southern Corporation, a consumer and office products and servicestransportation company, since 2002July 2011, serving on its Audit and he has been a director of Deere & Company, a farm and construction machinery company, since 2004. He serves on the CompensationGovernance and Nominating and Governance Committees of 3M and the Compensation and Corporate Governance Committees of Deere. Dr. Coffman was also director of Bristol-Myers Squibb Company, a pharmaceutical company, and a member of its Audit, Governance and Compliance Committees, from 1998 to 2007.

Dr. Coffman was the Chairman of the Board and Chief Executive Officer of Lockheed Martin Corporation, an aerospace and defense company, from 1998 to 2005, and was ex officio member of all board committees. From 1997 to 1998, he was Vice Chairman of the Board and Chief Executive Officer of Lockheed Martin. He is currently on the Board of Trustees of the Naval Postgraduate School Foundation, the Advisory Board of Stanford University and the Board of Governors of the Iowa State University Foundation. Dr. Coffman has been a Member of the National Academy of Engineering since 1997 and a Fellow of the American Institute of Aeronautics and Astronautics and the American Astronautical Society since 1989 and 1997, respectively.Committees.

The Board concluded that Dr. CoffmanMr. Bradway should serve on the Board as duringdue to Mr. Bradway’s knowledge of all aspects of our business, combined with his service as Chairman of the Board and Chief Executive Officer of Lockheed Martin, Dr. Coffman acquired important leadership and management skills that provide insight intohaving served as our President and Chief Operating Officer and formerly our Chief Financial Officer. During this time, Mr. Bradway provided strong leadership through a variety of challenges and this positions him well to serve as a director and provides the operations of our CompanyBoard with a knowledgeable perspective with regard to the Company’s products and the challenges of managing a complex organization.operations.

10

FRANÇOIS DE CARBONNELï 2014 Proxy Statement

Mr.

| ITEM 1 — ELECTION OF DIRECTORS |

François de Carbonnel

François de Carbonnel is a director of corporations and corporate advisor. Mr. de Carbonnel was a director of Thomson S.A., a French multimedia corporation, from 2007 to January 2010, serving as Chairman of the Audit Committee since April 2007throughout his tenure as a director, and as non-executive Chairman of the Board from April 2008 to April 2009. He has also been a director and ChairmanPresident of the Remuneration and Nominating Committee of Solocal Group (formerly known as Pages Jaunes S.A.), a French company which offers online content, advertising solutions and transactional services and publishes directories, and internet band advertising, since 2004 and serves as chairman of Quilvest S.A., a Luxembourg company which provides wealth managementthe Remuneration and private equity services, since 2006.Appointments Committee. In 2013, Mr. de Carbonnel was appointed lead director of Solocal Group. Mr. de Carbonnel has been a director of Mazars Group, a privately-held international organization specializing in audit, accountancy, tax, legal and advisory services since December 2011, where he also serves as chair of the Audit Committee. Mr. de Carbonnel has been a director of Groupe Foncier de L’Ile de France (GFI), a privately-held French real estate company since 1995. Mr. de Carbonnel became the Chairman of Woodside Holdings Investment Management Pte. Ltd., a non-listed Singapore-based fund management company, in 2012. From 2004 until October 2013, Mr. de Carbonnel was a director of a number of funds managed by Ecofin, a privately-held investment management firm that provides discretionary fund management services and advice to institutions, utilities and infrastructure industries since 2004industries. Mr. de Carbonnel was a director of Quilvest S.A., a Luxembourg company which

provides wealth management and of Mazars Group, a privately-held international organization specializing in audit, accountancy, tax, legal and advisoryprivate equity services, since December 2011.from 2006 to 2012.

Mr. de Carbonnel was the Senior Advisor of the Global Corporate and Investment Bank of Citigroup from 2004 to 2006, and its Managing Director from 1999 to 2004. He was the Chairman and Chief Executive Officer of Midial S.A., a French listed company, from 1994 to 1998, Chairman of General Electric Capital SNC from 1996 to 1998. He was a corporate Vice President of General Electric Company and President of General Electric Capital-Europe from 1990 to 1992, President of Strategic Planning Associates, an international consulting company, from 1981 to 1990 and Vice President of Boston Consulting Group from 1971 to 1981. He has been a member of the business board of advisors of the Carnegie Mellon Tepper School of Business since 1984. Mr. de Carbonnel is a French citizen and resides in Europe.

The Board concluded that Mr. de Carbonnel should serve on the Board because Mr. de Carbonnel has acquired knowledge, skills and brings a strong vantage point through his international career as an executive officer of well-known consulting companies as well as a number of public companies. This perspective is important as the Company undertakes further global expansion plans. Given his experience in the financial industry, Mr. de Carbonnel has been determined to be an Audit Committee financial expert by our Board.

REBECCA M. HENDERSONï 2014 Proxy Statement11

| ITEM 1 — ELECTION OF DIRECTORS |

Vance D. Coffman

Vance D. Coffman is our lead independent director. Dr. Coffman has been a director of 3M Company, a consumer and office products and services company, since 2002 and he has been a director of Deere & Company, a farm and construction machinery company, since 2004. He serves on the Nominating and Governance Committee and chairs the Compensation Committee of 3M Company and serves on the Corporate Governance and Executive Committees and chairs the Compensation Committee of Deere & Company. Dr. Coffman was also director of Bristol-Myers Squibb Company, a pharmaceutical company, and a member of its Audit and Governance Committees, from 1998 to 2007.

Dr. Coffman was the Chairman of the Board and Chief Executive Officer of Lockheed Martin Corporation, an aerospace and defense company, from 1998 to 2005, and was ex officio member of all board committees. From 1997

to 1998, he was Vice Chairman of the Board and Chief Executive Officer of Lockheed Martin. He is currently on the Board of Trustees of the Naval Postgraduate School Foundation, the Stanford Engineering Advisory Council of Stanford University and the Board of Governors of the Iowa State University Foundation. Dr. Coffman has been a Member of the National Academy of Engineering since 1997 and a Fellow of the American Institute of Aeronautics and Astronautics and the American Astronautical Society since 1989 and 1997, respectively.

The Board concluded that Dr. Coffman should serve on the Board as during his service as Chairman of the Board and Chief Executive Officer of Lockheed Martin, Dr. Coffman acquired important leadership and management skills that provide insight into the operations of our Company and the challenges of managing a complex organization.

Robert A. Eckert

Robert A. Eckert was the Chief Executive Officer of Mattel, Inc., a toy design, manufacture and marketing company, having held this position from 2000 through December 2011. He was President and Chief Executive Officer of Kraft Foods Inc., a consumer packaged food and beverage company, from 1997 to 2000, Group Vice President from 1995 to 1997, President of the Oscar Mayer Foods Division from 1993 to 1995 and held various other senior executive and other positions from 1977 to 1992.

Mr. Eckert was Chairman of the Board of Mattel, Inc. from 2000 through 2012. He has been a director of McDonald’s Corporation, a company which franchises and operates McDonald’s restaurants in the global restaurant industry, since 2003, serving as the Chair of the Compensation Committee and a member of the Executive and Governance Committees. Mr. Eckert has been a director of Smart & Final

Stores LLC, a privately-held warehouse store, since 2013. Mr. Eckert also has served as a director of Levi Strauss & Co., a privately-held jeans and casual wear manufacturer, since 2010. Mr. Eckert is on the Global Advisory Board of the Kellogg Graduate School of Management and serves on the Eller College National Board of Advisors at the University of Arizona.

The Board concluded that Mr. Eckert should serve on our Board because of Mr. Eckert’s recent and long-tenured experience as a Chief Executive Officer of large public companies, his broad international experience in marketing and business development and his valuable leadership experience. Given his financial and leadership experience, Mr. Eckert has been determined to be an Audit Committee financial expert by our Board.

12  ï 2014 Proxy Statement

ï 2014 Proxy Statement

Dr.

| ITEM 1 — ELECTION OF DIRECTORS |

Greg C. Garland

Greg C. Garland has served as a director of the Company since October 2013. Mr. Garland was first identified to the Governance and Nominating Committee as a potential director candidate by the Board of Directors’ outside director search firm. Mr. Garland is the Chairman, President and Chief Executive Officer of Phillips 66, an energy manufacturing and logistics company with midstream, chemical, refining and marketing and specialties businesses created through the repositioning of ConocoPhillips, having held this position since April 2012. Mr. Garland chairs the Executive Committee of Phillips 66. Prior to Phillips 66, Mr. Garland served as Senior Vice President, Exploration and Production, Americas of ConocoPhillips from 2010 to April 2012. He was President and Chief Executive Officer of

Chevron Phillips Chemical Company (now a joint venture between Phillips 66 and Chevron) from 2008 to 2010 and Senior Vice President, Planning and Specialty Chemicals from 2000 to 2008. Mr. Garland served in various positions at Phillips Petroleum Company from 1980 to 2000. Mr. Garland is a member of the Engineering Advisory Board for Texas A&M University.

The Board concluded that Mr. Garland should serve on our Board because of Mr. Garland’s experience as a Chief Executive Officer and his over 30 years of international experience in a highly regulated industry. Given his financial and leadership experience, Mr. Garland has been determined to be an Audit Committee financial expert by our Board.

Rebecca M. Henderson

Rebecca M. Henderson has been the John and Natty McArthur University Professor at Harvard University since September 2011, andwhere she has been on the faculty ofa joint appointment at the Harvard Business School, servingand is the Co-Director of the Business and Environment Initiative. From 2009 to 2011, Dr. Henderson served as the Senator John Heinz Professor of Environmental Management since July 2009.at Harvard Business School. Prior to this, she was a professor of management at MIT for 21 years, having been the Eastman Kodak LFM Professor of Management since 1999. Since 1995, she has also been a Research Associate at the National Bureau of Economic Research. She specializes in technology strategy and the broader strategic problems faced by companies in high technology industries. Dr. Henderson has been a director of IDEXX Laboratories, Inc., a company which develops and commercializes technology-based products and services for veterinary, food and water applications, since 2003, serving on its Finance Committee and chairing its Nominating and Governance Committees.Committee.

Dr. Henderson has also served as a director of the Ember Corporation, a privately-held semiconductor chip manufacturer,

and on its Compensation Committee, from 2001 to July 2009. She has further been a director of Linbeck Construction Corporation, a privately-held facility solutions company.company, from 2000 until 2004. In May 2011, Dr. Henderson was appointed to the U.S. Department of Commerce Innovation Advisory Board which was established as a result of the America COMPETES Reauthorization Act of 2010 signed into law by President Obama on January 4, 2011 and will guidewhich guided a study of U.S. economic competitiveness and innovation to help inform national policies at the heart of U.S. job creation and global competitiveness. Dr. Henderson has published articles, papers and reviews in a range of scholarly journals, and sits on the editorial board ofResearch Policy, a multi-disciplinary journal. Dr. Henderson received an undergraduate degree from the Massachusetts Institute of Technology and a doctorate from Harvard University.

The Board concluded that Dr. Henderson should serve on the Board because Dr. Henderson’s study of the complex strategy issues faced by high technology companies provides unique insight into the Company’s strategic and technology issues.

FRANK C. HERRINGERï 2014 Proxy Statement13

Mr.

| ITEM 1 — ELECTION OF DIRECTORS |

Frank C. Herringer

Frank C. Herringer has been Chairman of the Board of Transamerica Corporation, a financial services company, since 1995. Mr. Herringer was an executive with Transamerica for 20 years, including its Chief Executive Officer from 1991 until its acquisition by Aegon N.V., a life insurance, pensions and asset management company, in 1999, subsequently serving on Aegon’s Executive Board for one year and he is currently a director of Aegon USU.S. Holding Corporation.Corporation, a position he has held since 1999. Mr. Herringer has been a director of The Charles Schwab Corporation, a brokerage and banking company, since 1996, serving on its Compensation, Nominating and Corporate Governance Committees, and of Safeway Inc., a food and drug retailer, since 2008, serving on its Executive Compensation and Executive Committees and chairing its Nominating and Corporate Governance Committees.Committee. He is also currently a director of Cardax Pharmaceuticals, Inc., a biotechnology company, which he joined in 2005, and a member of the

Board of Trustees of the California Pacific Medical Center Foundation, a not-for-profit organization which develops philanthropic resources for the California Pacific Medical Center, a privately-held, not-for-profit academic medical center, which he joined in 2013. From 2002 to 2005, Mr. Herringer was a director of AT&T Corporation, and a member of its Audit and Compensation Committees. He is also currently a director of Cardax Pharmaceuticals, Inc., a privately-held biotechnology company, and sat on the Board of Trustees of the California Pacific Medical Center, a privately-held not-for-profit academic medical center, from 1983 until 2009. In 2004, Mr. Herringer was named an Outstanding Director of the Year by the Outstanding Director’sDirectors Exchange. Mr. Herringer received an undergraduate degree and master of business administration from Dartmouth College.

The Board concluded that Mr. Herringer should serve on the Board due to Mr. Herringer’s career as Transamerica’s Chief Executive Officer and Chairman of the Board which developed Mr. Herringer’s management and leadership skills and provides an informed perspective on our financial performance, prospects and strategy.

TYLER JACKSTyler Jacks

The Governance and Nominating Committee has recommended Dr.

Tyler Jacks as a new nominee to stand for initial election to the Board at the Annual Meeting. Dr. Jacks was first identified to the Governance and Nominating Committee as a potential director candidate by Dr. David Baltimore, a member of the Company’s Board. Dr. Jacks joined the Massachusetts Institute of Technology in 1992 and is currently the David H. Koch Professor of Biology and director of the David H. Koch Institute for Integrative Cancer Research, which brings together biologists and engineers to improve detection, diagnosis and treatment of cancer. Dr. Jacks has been an investigator with the Howard Hughes Medical Institute, a nonprofit medical research organization, since 2002.1994. Dr. Jacks has been a director of Thermo Fisher Scientific, Inc., a life sciences supply company, since May 2009, and serves on its Strategy and Finance Committee and scientific advisory board. He was a founder of T2 Biosystems, Inc., a privately-held biotechnology company, since 2006.2006 and served on the scientific advisory board until 2013. Dr. Jacks serves on numerousis a consultant scientific advisory boards includingadvisor to Epizyme, Inc., a privately-held biopharmaceutical company, since 2007 and2007. Dr. Jacks served on the scientific advisory board of Aveo Pharmaceuticals Inc., a cancer therapeutics company, since 2001. Dr. Jacksfrom 2001 until 2013. He was appointed to the National Cancer Advisory Board, which advises and assists the Director of the National Cancer Institute with respect to the National Cancer Program, in

October 2011. Dr. Jacks was a director of the Massachusetts Institute of Technology’s Center for Cancer Research from 2001 to 2008 and received numerous awards including the Paul Marks Prize for Cancer Research and the American Association for Cancer Research Award for Outstanding Achievement. He was elected to the National Academy of Sciences as well as the Institute of Medicine in 2009.

The Board concluded that Dr. Jacks should serve on the Board due to Dr. Jacks’ extensive scientific expertise relevant to our industry, including his broad experience as a cancer researcher and service on several scientific advisory boards. His expertise in the field of oncology, which includes pioneering the use of technology to study cancer-associated genes and to construct animal models of many human cancer types, is evidenced by his recent appointment to the National Cancer Advisory Board and by his numerous awards for cancer research. Dr. Jacks’ scientific knowledge and thorough understanding of our industry positions him to provide valuable insights into the scientific activities of our Company.

14

GILBERT S. OMENNï 2014 Proxy Statement

Dr. Gilbert S. Omenn has been Professor of Internal Medicine, Human Genetics and Public Health and Director of the Center for Computational Medicine and Bioinformatics at the University of Michigan since 1997. From 1997 to 2002, he was the Chief Executive Officer of the University of Michigan Health System and Executive Vice President of the University of Michigan for Medical Affairs. Previously he was a professor of medicine and of environmental health and Dean of the School of Public Health and Community Medicine at the University of Washington, as well as a senior member of the Fred Hutchinson Cancer Research Center. He has been an affiliate faculty member of the Institute for Systems Biology in Seattle since June 2009.

| ITEM 1 — ELECTION OF DIRECTORS |

Dr. Omenn was a director of Rohm & Haas Co., a manufacturer of specialty chemicals (now a wholly-owned subsidiary of The Dow Chemical Company) from May 1987 until March 2009, where he served on the Audit, Nominating, and Sustainability Committees, and of OccuLogix, Inc., an early-stage eye disease therapy company, from 2005 until 2008, serving on its Finance and Compensation Committees. Dr. Omenn has been a member of the scientific advisory boards of: Motorola, Inc., an electronics and equipment company, from 1998 to December 2010; Galectin Therapeutics, Inc. (formerly Pro-Pharmaceuticals Inc), an early-stage pharmaceutical company, since July 2009; Compendia Biosciences Inc., a privately-held bioinformatics firm, since February 2007; Innocentive Innovation Inc., a privately-held information technology firm, since 2006, and Armune BioSciences, Inc. a privately-held early-stage in vitro diagnostic company, since February 2008, as well as a director of the latter.

Dr. Omenn’s civic, scientific and non-profit leadership roles include serving as a director of the Harvard Medical Alumni Association, Hastings Center, the Center for Public Integrity, the U.S. Civilian R&D Foundation CRDF-Global, Population Services International, Center for Naval Analysis (CNA) and the Salzburg Global Seminar. Previously, he served as a director of United Way, the Fred Hutchinson Cancer Research Center, and the American Association for the Advancement of Science. Earlier he served as Associate Director of the Office of Science and Technology Policy and Associate Director of the Office of Management and Budget in the Executive Office of the President of the United States from 1977 to 1981 and Chair of the Presidential/Congressional Commission on Risk Assessment and Risk Management from 1994 to 1997. Dr. Omenn has received several honors and awards and has published many significant papers, reviews and books.

The Board concluded that Dr. Omenn should serve on the Board due to Dr. Omenn’s broad scientific, medical and research experience, including his leadership roles at the University of Michigan and the University of Washington, which provides perspectives on the requirements and behaviors of the medical community as well as special insight into the research and development, risk management, and compliance activities of our Company.

JUDITHJudith C. PELHAMPelham

Ms.

Judith C. Pelham is the President Emeritus of Trinity Health, a national system of healthcare facilities, including hospitals, long-term care, home care, psychiatric care, residences for the elderly and ambulatory care, and one of the largest Catholic healthcare systems in the U.S. Prior to her current position at Trinity Health, she was the President and Chief Executive Officer of Trinity Health from 2000 to 2004, the President and Chief Executive Officer of Mercy Health Services, a system of hospitals, home care, long-term care, ambulatory services and managed care, from 1993 to 2000, the President and Chief Executive Officer of the Daughters of Charity Health Services of Austin, a network of hospitals, home care and ambulatory services, from 1982 to 1992, and the Assistant Vice President of Brigham and Women’s Hospital from 1976 to 1980.

In February 2011, Ms. Pelham becamehas been a director of Health Care REIT, Inc., a public real estate investment trust for senior living and health care real estate, since May 2012 and serves on its Compensation, Planning, Nominating/Corporate Governance and Investment Committees. Ms. Pelham was a director of Zoll Medical Corporation, a medical products and software solutions company.company, from February 2011 to April 2012 when it became a wholly owned subsidiary of Asahi Kasei Group. Ms. Pelham was a director of Eclipsys Corporation, a healthcare IT solutions company, from 2009 to August 2010 when it merged with AllScripts and was a member of its Compensation Committee. In addition, from 2005 to 2006 she was a director of Hospira, Inc., a specialty

pharmaceutical delivery company, and a member of its Audit and Public Policy and Compliance Committees. She also sits on the board of trustees of Smith College and is a member of its Audit, Finance, and Buildings and Grounds, and AdvancementLibraries Committees and chairs the Audit and Information Technology Committees.

Ms. Pelham has received numerous honors for her civic and healthcare systems leadership, including the CEO IT Achievement Award in 2004 from Modern Healthcare and the Healthcare Information Management Systems Society for her leadership in implementing information technology in healthcare provider organizations and the National Quality Healthcare Award in 2004 from the National Committee for Quality Healthcare, for innovation and implementation of clinical quality and patient safety systems. She received the American Hospital Association Partnership for Action Grassroots Advocacy Award in 1992 in recognition of her work in healthcare reform.

The Board concluded that Ms. Pelham should serve on the Board due to Ms. Pelham’s career as an executive leader at a number of large healthcare systems, as well her extensive experience developing programs to improve the health status of communities and championing innovation and advances in the delivery of, access to and financing of healthcare, provide anher understanding of the nation’s healthcare system, the patient populations served by our Company’s products and the operations of our Company.

J. PAUL REASONï 2014 Proxy Statement15

Admiral J. Paul Reason, USN (Retired) served as Commander-in-Chief of the U.S. Atlantic Fleet, as Naval Aide to the President of the United States and in numerous other roles and assignments in his 34 years career in the U.S. Navy. Upon leaving the Navy, Admiral Reason was an executive at SYNTEK Technologies, Inc., a consulting and professional services company, then served as the President and Chief Operating Officer of Metro Machine Corporation, a shipyard operator, from 2000 to 2005, and its Vice Chairman and President from 2005 to 2006. Since 2006, he has been an independent consultant.

| ITEM 1 — ELECTION OF DIRECTORS |

Admiral Reason has served as a director of Norfolk Southern Corporation, a transportation company, and on its Audit, Finance and Compensation Committees since 2002. Admiral Reason was a director of Todd Shipyards Corporation, a shipbuilding company, from 2007 until February 2011, when it ceased to be a public company and became a wholly-owned subsidiary of Vigor Industrial LLC, and served on its Compensation Committee since 2007. From 2001 to 2006, he was a director of Wal-Mart Stores, Inc., a retail company, and served on its Audit Committee. In addition to his active service in the U.S. Navy, Admiral Reason is a member of the National War Powers Commission and was Chairman of the U.S. Navy Memorial Foundation. He authoredSailing New SeasRonald D. Sugar, a blueprint for the governance of maritime forces in the 21st century. He has been the Chairman of ORAU Foundation, which provides educational and technical support to the Oak Ridge National Laboratory, and a member of the Naval Studies Board of National Academics NRC-NSB, both since 2007.

The Board concluded that Admiral Reason should serve on the Board due to Admiral Reason’s leadership in the U.S. Navy and in executive positions at Metro Machine Corporation which provides broad leadership and strategic skills and perspective, particularly with regard to interaction with government agencies in our heavily regulated industry.

LEONARD D. SCHAEFFER